Recently, Delta Air Lines announced it would expand its use of artificial intelligence to provide individualized prices to customers. This move sparked concern among flyers and politicians. But Delta isn’t the only business interested in using AI this way. Personalized pricing has already spread across a range of industries, from finance to online gaming.

Customized pricing – where each customer receives a different price for the same product – is a holy grail for businesses because it boosts profits. With customized pricing, free-spending people pay more while the price-sensitive pay less. Just as clothes can be tailored to each person, custom pricing fits each person’s ability and desire to pay.

I am a professor who teaches business school students how to set prices. My latest book, “The Power of Cash: Why Using Paper Money is Good for You and Society,” highlights problems with custom pricing. Specifically, I’m worried that AI pricing models lack transparency and could unfairly take advantage of financially unsophisticated people.

The history of custom pricing

For much of history, customized pricing was the normal way things happened. In the past, business owners sized up each customer and then bargained face-to-face. The price paid depended on the buyer’s and seller’s bargaining skills – and desperation.

An old joke illustrates this process. Once, a very rich man was riding in his carriage at breakfast time. Hungry, he told his driver to stop at the next restaurant. He went inside, ordered some eggs and asked for the bill. When the owner handed him the check, the rich man was shocked at the price. “Are eggs rare in this neighborhood?” he asked. “No,” the owner said. “Eggs are plentiful, but very rich men are quite rare.”

Custom pricing through bargaining still exists in some industries. For example, car dealerships often negotiate a different price for each vehicle they sell. Economists refer to this as “first-degree” or “perfect” price discrimination, which is “perfect” from the seller’s perspective because it allows them to charge each customer the maximum amount they’re willing to pay.

Hulton Archive/Getty Images

Currently, most American shoppers don’t bargain but instead see set prices. Many scholars trace the rise of set prices to John Wanamaker’s Philadelphia department store, which opened in 1876. In his store, each item had a nonnegotiable price tag. These set prices made it simpler for customers to shop and became very popular.

Why uniform pricing caught on

Set prices have several advantages for businesses. For one thing, they allow stores to hire low-paid retail workers instead of employees who are experts in negotiation.

Historically, they also made it easier for stores to decide how much to charge. Before the advent of AI pricing, many companies determined prices using a “cost-plus” rule. Cost-plus means a business adds a fixed percentage or markup to an item’s cost. The markup is the percentage added to a product’s cost that covers a company’s profits and overhead.

The big-box retailer Costco still uses this rule. It determines prices by adding a roughly 15% maximum markup to each item on the warehouse floor. If something costs Costco $100, they sell it for about $115.

The problem with cost-plus is that it treats all items the same. For example, Costco sells wine in many stores. People buying expensive Champagne typically are willing to pay a much higher markup than customers purchasing inexpensive boxed wine. Using AI gets around this problem by letting a computer determine the optimal markup item by item.

What personalized pricing means for shoppers

AI needs a lot of data to operate effectively. The shift from cash to electronic payments has enabled businesses to collect what’s been called a “gold mine” of information. For example, Mastercard says its data lets companies “determine optimal pricing strategies.”

So much information is collected when you pay electronically that in 2024 the Federal Trade Commission issued civil subpoenas to Mastercard, JPMorgan Chase and other financial companies demanding to know “how artificial intelligence and other technological tools may allow companies to vary prices using data they collect about individual consumers’ finances and shopping habits.” Experiments at the FTC show that AI programs can even collude among themselves to raise prices without human intervention.

To prevent customized pricing, some states have laws requiring retailers to display a single price for each product for sale. Even with these laws, it’s simple to do custom pricing by using targeted digital coupons, which vary each shopper’s discount.

How you can outsmart AI pricing

There are ways to get around customized pricing. All depend on denying AI programs data on past purchases and knowledge of who you are. First, when shopping in brick-and-mortar stores, use paper money. Yes, good old-fashioned cash is private and leaves no data trail that follows you online.

Second, once online, clear your cache. Your search history and cookies provide algorithms with extensive amounts of information. Many articles say the protective power of clearing your cache is an urban myth. However, this information was based on how airlines used to price tickets. Recent analysis by the FTC shows the newest AI algorithms are changing prices based on this cached information.

Third, many computer pricing algorithms look at your location, since location is a good proxy for income. I was once in Botswana and needed to buy a plane ticket. The price on my computer was about $200. Unfortunately, before booking I was called away to dinner. After dinner my computer showed the cost was $1,000 − five times higher. It turned out after dinner I used my university’s VPN, which told the airline I was located in a rich American neighborhood. Before dinner I was located in a poor African town. Shutting off the VPN reduced the price.

Last, often to get a better price in face-to-face negotiations, you need to walk away. To do this online, put something in your basket and then wait before hitting purchase. I recently bought eyeglasses online. As a cash payer, I didn’t have my credit card handy. It took five minutes to find it, and the delay caused the site to offer a large discount to complete the purchase.

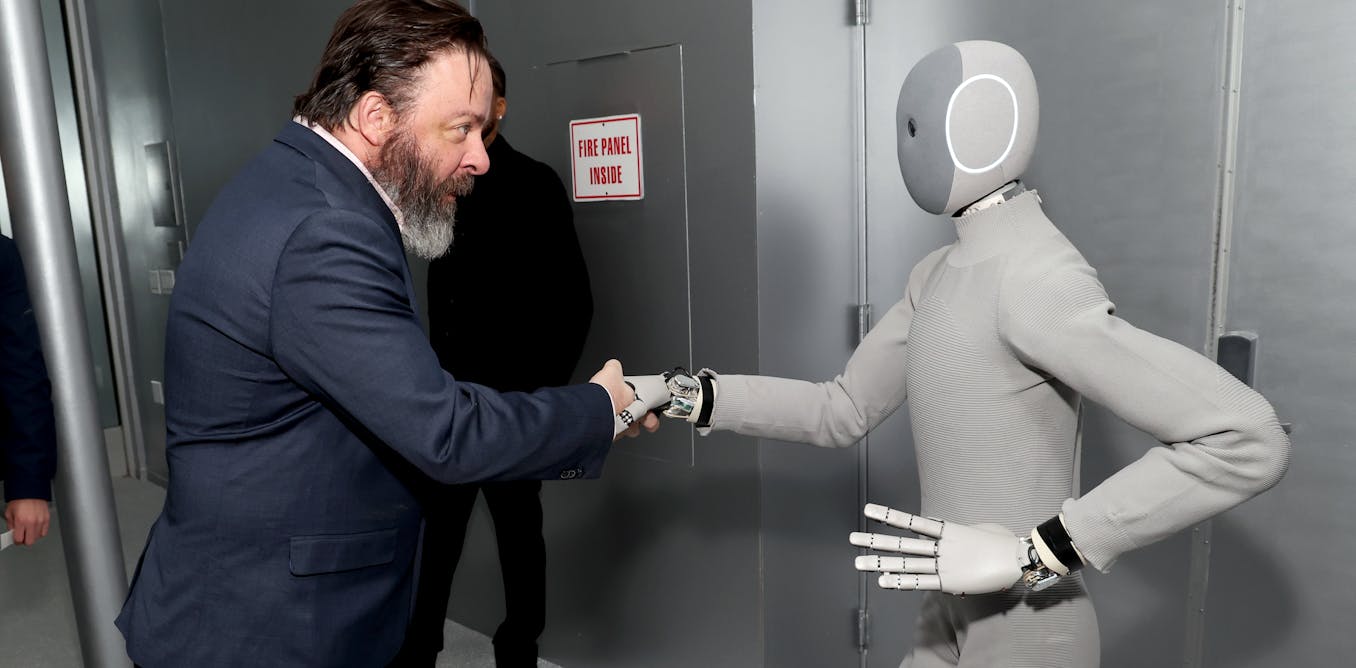

The computer revolution has created the ability to create custom products cheaply. The cashless society combined with AI is setting us up for customized prices. In a custom-pricing situation, seeing a high price doesn’t mean something is higher quality. Instead, a high price simply means a business views the customer as willing to part with more money.

Using cash more often can help defeat custom pricing. In my view, however, rapid advances in AI mean we need to start talking now about how prices are determined, before customized pricing takes over completely.

The post “What is personalized pricing, and how do I avoid it?” by Jay L. Zagorsky, Associate Professor Questrom School of Business, Boston University was published on 07/31/2025 by theconversation.com